Prospectus

Tear Sheet

YTD Performance

Latest NAV

AXONIC STRATEGIC INCOME FUND

The Fund seeks to maximize total return, through a combination of current income and capital appreciation. In pursuing its investment objective, the fund seeks to maximize risk-adjusted total returns by investing primarily in income-producing instruments (i.e., under normal circumstances, the fund will invest at least 60% of its net assets in income-producing instruments).

The Fund also may invest in real estate investment trusts (“REIT”), equity securities of companies whose business is substantially related to the mortgage business, and mortgage derivatives such as stripped RMBS and inverse floaters. The fund is non-diversified. Benchmark: Bloomberg US Agg Bond TR USD

Fund Facts

Performance

| MTD | YTD | 1 YEAR | 3 YEAR | ANNUALIZED SINCE INCEPTION | CUMULATIVE SINCE INCEPTION (7/16/2020) | |

|---|---|---|---|---|---|---|

| Axonic Strategic Income Fund - A | -0.04% | 1.92% | 7.60% | 4.93% | 4.81% | 25.04% |

| Bloomberg US Aggregate Bond Index | -0.78% | 1.98% | 6.38% | 0.00% | -1.35% | -6.25% |

While the Fund’s fiscal year ends on October 31, YTD and annualized since inception time periods are based on a calendar year, unless otherwise indicated.

The Class A shares will have substantially similar annual returns to the Class I shares because the shares are invested in the same portfolio of securities and the annual returns will differ only to the extent that the classes do not have the same expenses.

Class A shares of the Fund are subject to a maximum sales charge imposed on purchases (as a percentage of offering price) of 2.25%.” underneath the disclosure, “The Class A shares will have substantially similar annual returns to the Class I shares because the shares are invested in the same portfolio of securities and the annual returns will differ only to the extent that the classes do not have the same expenses.

Performance quoted represents past performance and is not a guarantee or a reliable indicator of future results. Investment return and the principal value of an investment will fluctuate. Shares may be worth more or less than their original cost when redeemed. Current performance may be lower or higher than average annual returns shown. Performance quoted does not reflect any sales charges, if applicable, and performance would be lower if it did.

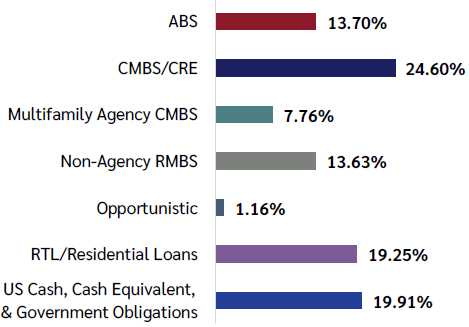

Fund Characteristics

Literature

For more information about our historical performance and examples of investment opportunities, please contact us at 212-259-0430 or investorrelations@axoniccap.com.

Disclosures

Distributions from the Fund’s net investment income are accrued daily and typically paid quarterly. However, there can be no assurances that the Fund will achieve any level of distribution to its Shareholders.

Investors should consider the investment objectives, risks, charges and expenses of the Fund carefully before investing. This and other information are contained in the Fund’s prospectus which may be obtained by clicking this link. Please read it carefully before you invest or send money.

Asset-Backed Securities are a financial security collateralized by a pool of assets such as loans, leases, credit card debt, royalties or receivables.

Asset-Backed Securities Risks. Asset-backed securities are subject to credit risk, interest rate risk, and to a lesser degree, prepayment risk. Asset-backed securities may also be subject to additional risks, including the fact that underlying assets may be unsecured.

Commercial and Residential Mortgages and Loans Risks. Investing in commercial and residential mortgage loans involves the general risks typically associated with investing in traditional fixed-income securities (including interest rate and credit risk) and certain additional risks and special considerations (including the risk of principal prepayment and the risk of investing in real estate).

Commercial Mortgage-Backed Securities (CMBS) secured by mortgages on commercial properties rather than residential real estate.

Commercial Mortgage-Backed Securities Risks. Collateral underlying CMBS generally consists of mortgage loans secured by income-producing property or other CMBS. Performance of a commercial mortgage loan and the market value of a commercial property both depend primarily on the net income generated by the underlying mortgaged property and performance of the related business (including property management). As a result, income generation will affect both the likelihood of default and the severity of losses with respect to a commercial mortgage loan. Issues associated with managing a commercial property may impact both performance and market value. The value of commercial real estate is also subject to limitations on remedies imposed by bankruptcy laws and state laws regarding foreclosure and rights of redemption. In addition, the unavailability of real estate financing may lead to default of mortgage loans on commercial properties, and there is no recourse against the borrower’s assets other than the collateral except in the case of borrowers acting fraudulently or otherwise illegally. As a result, payments on the CMBS may be adversely affected in such cases.

Commercial Real Estate (CRE) is non-residential property that serves to generate income.

Current Distribution Rate is distributions from the Fund’s net investment income are accrued daily and typically paid monthly. However, there can be no assurances that the Fund will achieve any level of distribution to its Shareholders. The Fund intends to make sufficient distributions of its ordinary taxable income and capital gain net income prior to the end of each calendar year to avoid liability for the excise tax. The character of income and gains to be distributed is determined in accordance with income tax regulations, which may differ from Generally Accepted Accounting Principles. The distribution yield is calculated by annualizing actual dividends distributed for the monthly period ended on the date shown and dividing by the net asset value on the last business day for the same period. The yield does not include long-or short-term capital gains distributions or the return of capital.

Derivatives Risks. Credit derivatives are contracts that transfer price, spread and/or default risks of debt and other instruments from one party to another. Such instruments may be illiquid or less liquid, volatile, difficult to price and leveraged so that small changes in the value of the underlying instruments may produce disproportionate losses to the Fund. In addition, the Fund is subject to the credit risk associated with the underlying assets of a derivatives contract as well as the risk of counterparty default. As a result, the Fund’s use of derivatives could result in losses, which could be significant.

Duration calculates the expected price decline of a bond when interest rates rise by 1%.

Non-Agency Residential Mortgage-Backed Securities (Non-Agency RMBS) are a form of debt-based securities which are backed by the principal and interest payments on loans for residences.

Residential Mortgage-Backed Securities (RMBS) are a form of debt-based securities which are backed by the principal and interest payments on loans for residences. There are two types of residential mortgage-backed securities: agency or non-agency (see above for non-agency definition). Agency RMBS are created by one of three agencies. These are Government National Mortgage Association (GNMA or Ginnie Mae), Federal National Mortgage (FNMA or Fannie Mae), and Federal Home Loan Mortgage Corp. (Freddie Mac).

Residential Mortgage-Backed Securities Risks. Collateral underlying RMBS generally consists of mortgage loans secured by residential real estate or other RMBS. In addition to the risks associated with other asset-backed securities as described above, mortgage-backed securities are subject to the general risks associated with investing in real estate securities; that is, they may lose value if the value of the underlying real estate to which a pool of mortgages relates declines. In addition, the rate of prepayments on underlying mortgages affects the price and volatility of a mortgage-backed security, and may have the effect of shortening or extending the effective maturity beyond what was anticipated.

REIT Risk. Investments in REITS and in securities of other companies principally engaged in the real estate industry subject the Fund to, among other things, risks similar to those of direct investments in real estate and the real estate industry in general. These include risks related to general and local economic conditions, possible lack of availability of financing and changes in interest rates or property values.

Weighted Average Price. This calculation excludes any assets without a state coupon or allocated principal.

This material has been distributed for informational purposes only and should not be considered as investment advice or a recommendation of any particular security, strategy or investment product. No part of this material may be reproduced in any form, or referred to in any other publication, without express written permission.

Investing involves risks, including loss of principal.

For more information about the funds’ risks, please refer to the AXSIX prospectus. Please see the AXSIX Primer for performance information.

ALPS Distributors, Inc. is the distributor of the Axonic Funds. Axonic Capital LLC and ALPS Distributors, Inc. are not affiliated. ALPS Distributors, Inc., 1290 Broadway, Suite 1000, Denver, CO, 80203